Economic Reality

In nominal terms, USA is 24%, China is 19%, EU is 17%, Japan is 7% of Global GDP.

in PPP terms, USA is 16%, China is 20% & EU is 15%, Japan is 4% of Global GDP.

India, Indonesia, Russia, Brazil, Mexico, Turkey (Rest Multipolar Big) together are hardly 15% of Global GDP in nominal terms & 25% of Global GDP in PPP terms.

so US + EU + Japan is 48% as share of nominal Global GDP and 35% in PPP terms.

China + Rest Multipolar Big is 34% of Global GDP in nominal terms and 45% in PPP terms.

PPP measures GDP in kind and so is better indicator to judge amount of oil, gas and other commodities needed in a country.

Economic Implications

So we can safely say China + Rest Multipolar Big account for 22% more demand in oil and commodity markets compared to US + EU + Japan.

But current prices better measure land prices and asset prices and also quality of endowment (workers, machines, researchers) which are 30% better for US + EU + Japan compared to China + Rest Multipolar Big.

Since Brazil and Russia are by themselves big commodity sellers, China + Rest Multipolar Big's edge over US + EU + Jap in commodity market is lost in a big way. Moreover, USA is self sufficient in oil and food now. Say 22% edge is reduced to 10% edge. And the edge is mainly over EU and not over USA.

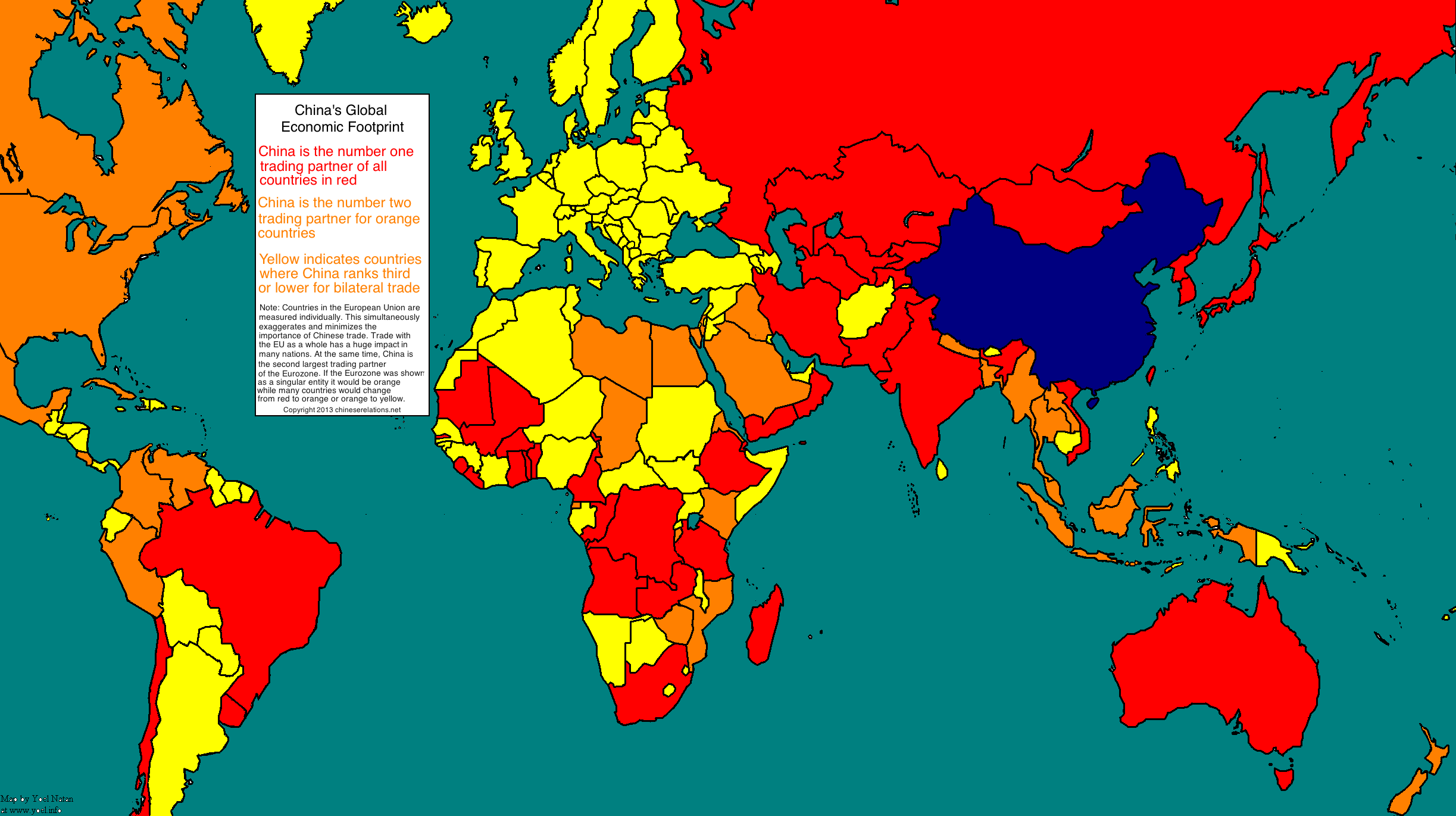

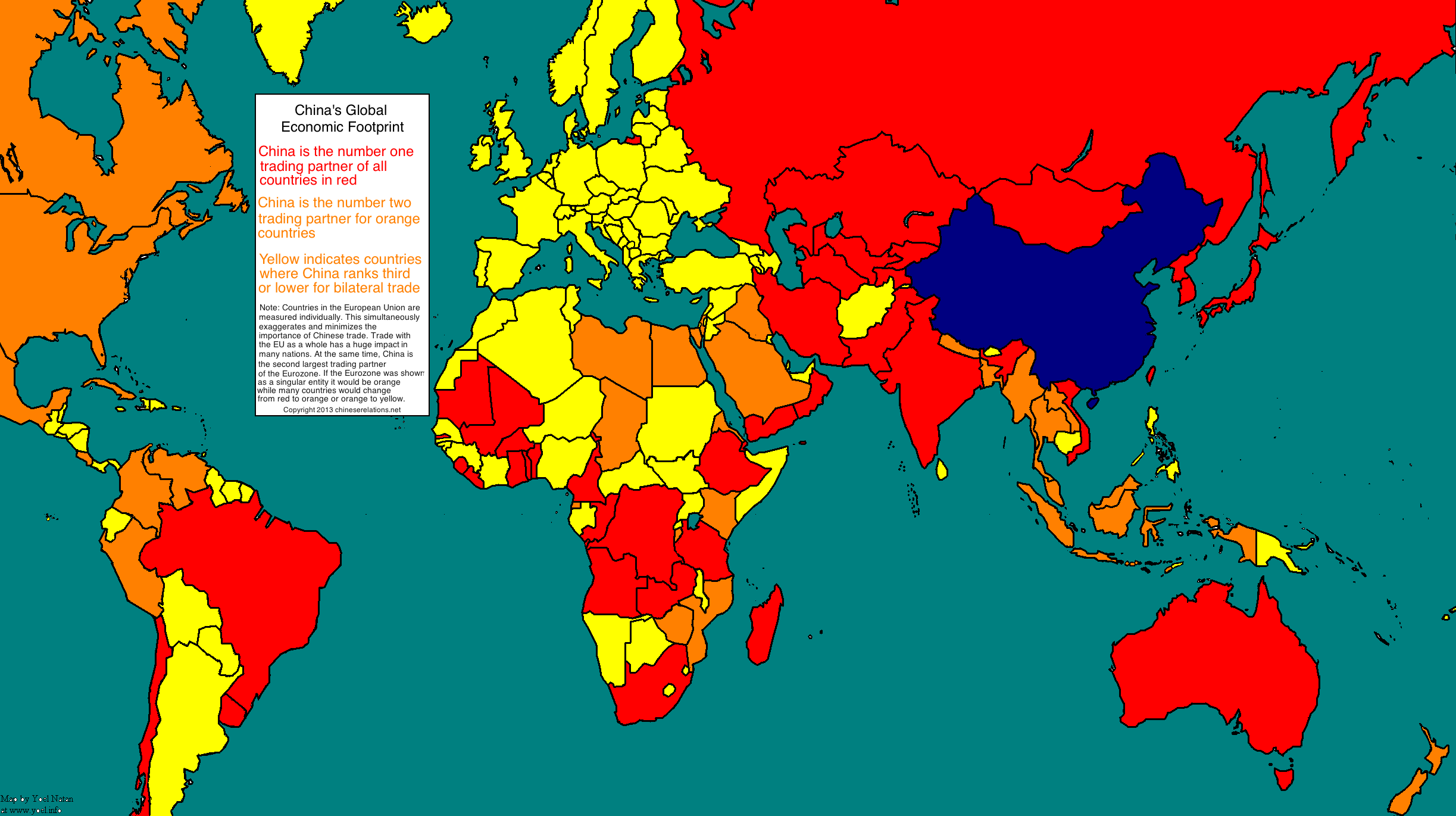

China being largest retail market, most profit making labor market and highest growing financial market surely creates a big influence on US, EU and Japan investors. Chinese made products help to keep inflation level low in USA, EU and Japan too.

So it can be concluded that China can create havoc in USA, EU and Japan through its role as global manufacturing hub while Russia and Brazil can create high inflation especially in EU and to a less extent in USA and Japan through its important role in global commodity markets. Russia and Brazil can also get new markets of commodities they sell if USA, EU and Japan markets are lost.

USA and EU's main strength lies in global asset market and quality of researchers and workers and machines. Other than China no other Multipolar Big are in a position to challenge USA and EU in asset market and quality factor. China needs to dominate its neighborhood militarily to make its asset market and quality at par with USA and EU. For this China has to keep raising naval assets in South China Sea at a faster rate than USA and tame in India through military actions (since trade investment options did not work between China and India).

Conclusion

By next year, it seems EU will face economic disasters due its economic war against Russia. USA will face severe inflation but is likely to avoid economic disasters. Japanese economic stagnation (since 1990s) will continue. USA may try to mitigate the inflation by ending some of trade wars against China launched by Trump in 2017. USA will continue to ask Gulf Arabs to reduce oil price as only this can severely impact Russian economy. But there is very little hope that USA will be able to make Gulf Arabs lower oil price. China will continue to enjoy cheap oil, gas from Russia and may even get good trade deal from USA. But time has come when China has to show its military prowess before the world. May be by next year, China will be ready with a High Tech War with India. Defeating India in a War of Cognition is the most feasible way by which China will be able to dominate its neighborhood militarily and make yuan an important global currency like USD and Euro and hence will make Chinese asset market and quality of endowments at par with USA and EU. It is China India war that will determine the ultimate fate of Western Domination of l

Author: Saikat Bhattacharya